In Todays world managing your finance is most important thing . In this blog we have listed Best Financial Planning Apps for you which can easily manage your finance .

1. Mint

Mint is a widely used personal finance app that allows you to track your spending, create budgets, and set financial goals. It also provides insights into your financial health and offers suggestions for saving money.

Features :

1. Budgeting: Track expenses and create budgets.

2. Bill Reminders: Receive alerts for upcoming payments.

3. Goal Setting: Set and monitor financial goals.

4. Transaction Categorization: Automatically categorize transactions.

5. Credit Score Monitoring: Keep track of your credit score.

6. Personalized Tips: Receive customized money-saving suggestions.

7. Investment Tracking: Monitor your investment portfolio.

8. Net Worth Calculation: Calculate your overall financial worth.

9. Mobile Alerts: Get real-time notifications on account activity.

10. Multi-Platform Sync: Access Mint on various devices.

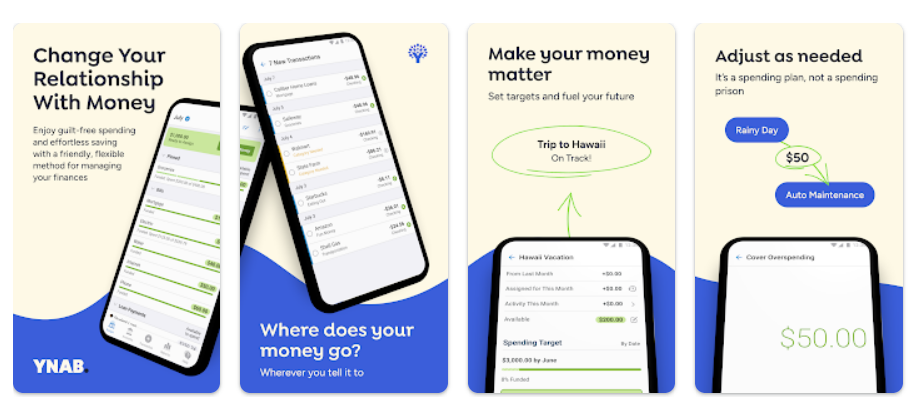

2. YNAB

YNAB focuses on budgeting and helps you allocate your money to different categories. It provides real-time updates on your spending and savings, promoting financial awareness.

Features :

1.Budgeting: Allocate your money to specific categories and track your spending.

2. Real-Time Sync: Seamlessly sync your budget across multiple devices in real-time.

3. Goal Tracking: Set and monitor financial goals to stay motivated.

4. Expense Tracking: Easily track and categorize your expenses on the go.

5. Debt Paydown: Plan and track your progress in paying off debts.

6. Account Reconciliation: Reconcile your accounts with your budget for accurate tracking.

7. Reports and Insights: Gain valuable insights into your spending patterns and trends.

8. Bank Syncing: Connect your bank accounts for automatic transaction importing.

9. Scheduled Transactions: Set up recurring transactions and payments for convenience.

10. Educational Content: Access to educational resources and materials to improve financial literacy.

3. Acorns

Acorns is an investment app that rounds up your purchases and invests the spare change. It offers automated investing and portfolio options based on your goals.

Features :

1. Acorns is an investment app that rounds up your purchases and invests the spare change. It offers automated investing and portfolio options based on your goals.

2. Round-Ups: Automatically invest spare change from everyday purchases.

3. Automated Investing: Set up recurring investments for hands-off wealth building.

4. Portfolio Options: Choose from a range of investment portfolios based on your goals and risk tolerance.

5. Found Money: Earn cashback on purchases from partnered brands, which is automatically invested.

6. Grow Your Knowledge: Access educational content and resources to improve your financial literacy.

7. IRA Options: Invest in an Individual Retirement Account (IRA) for long-term retirement savings.

8. Smart Portfolio Management: Benefit from automated rebalancing and diversification of your investments.

9. Spend Smart: Utilize the Acorns debit card for everyday purchases and earn extra investment rewards.

10. Multi-Factor Security: Protect your account with advanced security features like encryption and biometric login.

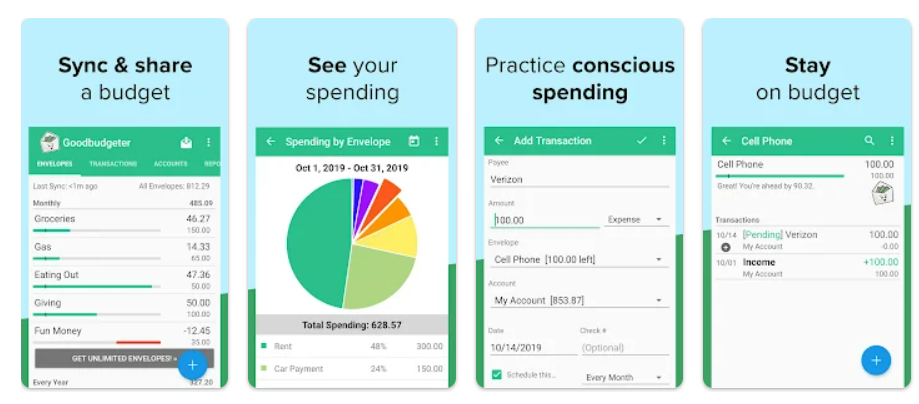

4.Good Budget

Goodbudget (formerly EEBA, the Easy Envelope Budget Aid) is a money manager and expense tracker that’s great for home budget planning. This personal finance manager is a virtual update on your grandma’s envelope system–a proactive budget planner that helps you stay on top of your bills and finances. Built for easy, real-time tracking

Features :

1. Expense Tracking: Easily record and categorize expenses to gain insights into spending habits.

2. Budget Creation: Set up personalized budgets for different categories and track progress.

3. Income Management: Track and manage your income sources for better financial planning.

4. Bill Reminders: Receive notifications and reminders for upcoming bill payments to avoid late fees.

5. Goal Setting: Set financial goals and track progress toward achieving them.

6. Savings Tracking: Monitor and track progress toward savings targets.

7. Financial Reports: Generate reports and visualizations to analyze spending patterns and financial health.

8. Account Syncing: Connect bank accounts and credit cards for automatic transaction imports.

9. Mobile Access: Access your budget and financial information on the go via mobile devices.

10. User-Friendly Interface: Enjoy a simple and intuitive interface for easy navigation and usability.

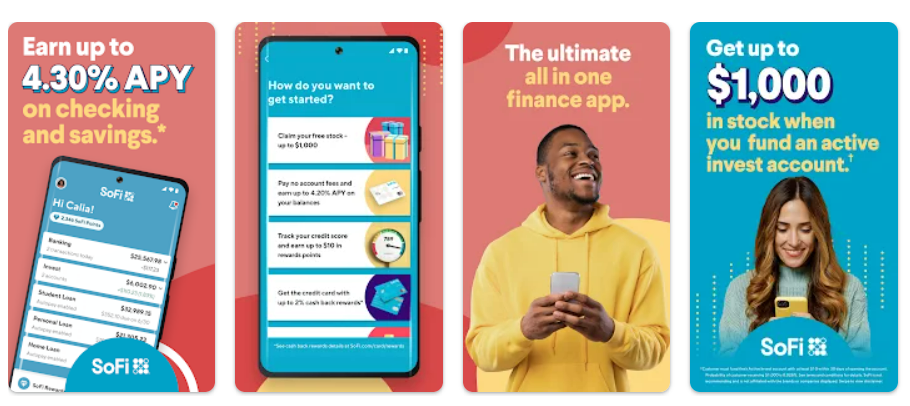

5. Sofi

SoFi is a financial platform that offers investment, banking, and lending services. It provides access to financial advisors and offers tools for budgeting and goal setting.

Features :

1.Investment Options: Access a range of investment options, including stocks, ETFs, and cryptocurrencies.

2. Personalized Financial Planning: Receive tailored financial planning guidance and advice.

3. Automated Investing: Set up automated recurring investments for hassle-free wealth building.

4. Cash Management: Enjoy a high-yield cash management account with no account fees.

5. Loan Services: Access personal loans, student loan refinancing, and mortgage services.

6. Robust Educational Resources: Learn about personal finance and investing through educational content and resources.

7. Stock Bits: Invest in fractional shares of popular stocks with small amounts of money.

8. Member Benefits: Unlock exclusive member benefits, such as discounts on financial products and services.

9. Community Features: Connect with a community of like-minded individuals to share insights and experiences.

10. Mobile Accessibility: Manage your finances on the go with a user-friendly mobile app.

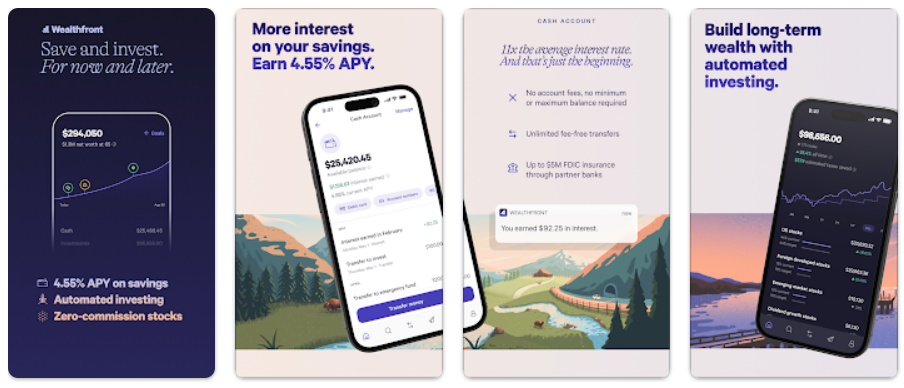

6. Wealth Front

Wealthfront is a robo-advisor that offers automated investment management services. It provides features like tax-loss harvesting, direct indexing, and cash management options.

Features :

1.Automated Investing: Utilize robo-advisory services for automated investment management.

2.Tax-Efficient Strategies: Benefit from tax-loss harvesting and tax-efficient portfolio management.

3. Goal-Based Planning: Set and track financial goals tailored to your specific needs.

4. Portfolio Diversification: Access a diversified portfolio of low-cost ETFs across multiple asset classes.

5. College Savings: Plan and invest in tax-advantaged 529 college savings accounts.

6. Cash Account: Earn a high-yield interest rate on uninvested cash in the Wealthfront Cash Account.

7. Financial Planning Tools: Access tools for retirement planning, home buying, and other financial decisions.

8. Direct Indexing: Optimize your investment returns with direct indexing strategies.

9. Portfolio Line of Credit: Utilize a portfolio line of credit for borrowing needs while keeping your investments intact.

10. Advanced Security: Enjoy advanced security features and encryption to protect your financial information.

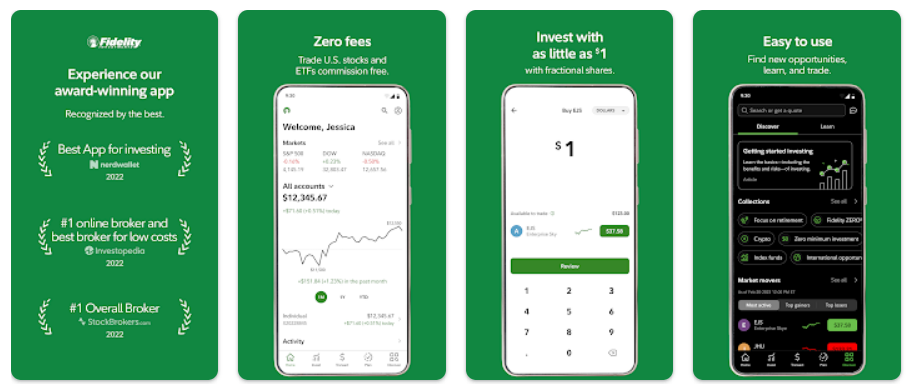

7. Fidelity

Invest at a firm invested in you. Fidelity’s is secure and easy-to-use award-winning app gives you access to a broad choice of investments, expert insights, and investing tools—helping you make smart decisions with your money.

Features :

1. Investment Options: Access a wide range of investment options, including stocks, bonds, mutual funds, and ETFs.

2. Portfolio Management: Monitor and manage your investment portfolio with ease.

3. Research and Insights: Access extensive market research, news, and analysis for informed decision-making.

4. Retirement Planning Tools: Plan for retirement with calculators, resources, and retirement account management.

5. Trading and Investing Tools: Execute trades, set up watchlists, and receive real-time market data.

6. Educational Resources: Access educational materials and insights to enhance your investing knowledge.

7. Mobile Deposits: Deposit checks into your Fidelity account conveniently through the app.

8. Security Features: Benefit from robust security measures to protect your account and personal information.

9. Account Management: View balances, track transactions, and manage account preferences.

10. Customer Support: Contact customer service and access support resources directly from the app.

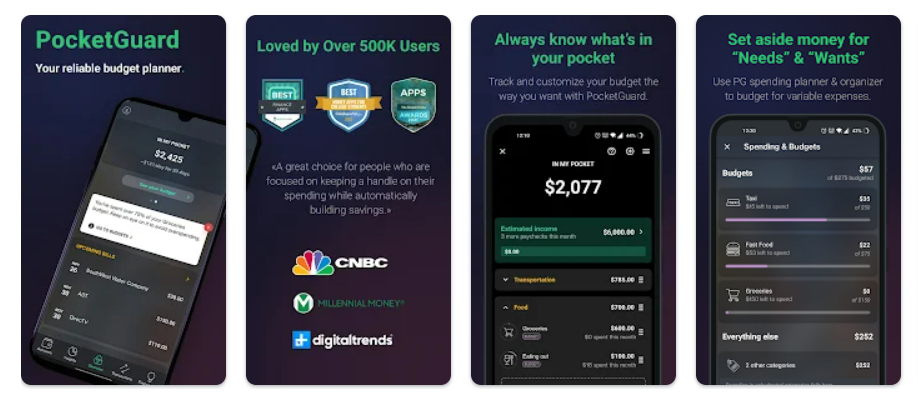

8. pocket Guard

The budget app software completely transforms the way you manage your spending thanks to its simple layout and wide range of useful functions for example, subscription manager.

Features :

1.Budgeting: Track and categorize your expenses to create a personalized budget.

2. Bill Tracking: Receive reminders and notifications for upcoming bill payments.

3. Smart Spending Analysis: Gain insights into your spending patterns and identify areas for improvement.

4. Goal Setting: Set financial goals and track your progress towards achieving them.

5. Savings Strategies: Discover ways to save money and reach your savings targets.

6. Customizable Alerts: Receive alerts for low balances, unusual spending, and budget deviations.

7. Cash Flow Management: Monitor your income and expenses to maintain a healthy cash flow.

8. Secure Connectivity: Connect your bank accounts securely for automatic transaction syncing.

9. Categorized Spending: View detailed breakdowns of your spending by category.

10. Personalized Recommendations: Receive personalized insights and recommendations to optimize your finances.

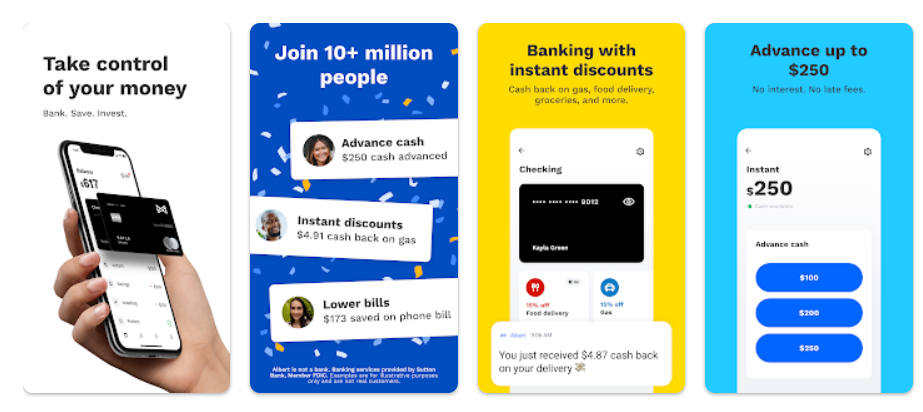

9. Albert

Bank, save, invest, and budget — with a Genius team of money experts to guide you. Get up to $250 with Instant and set up direct deposit to get paid up to 2 days earlier. With Genius you can also earn cash back with your debit card, save and invest automatically, and protect your money.

Download

Features :

1.Smart Savings: Utilize intelligent algorithms to automate savings and reach your financial goals faster.

2. Budgeting Tools: Create budgets, track expenses, and receive alerts to stay on top of your spending.

3. Income Tracking: Monitor your income streams and analyze your earning patterns.

4. Bill Negotiation: Get help negotiating bills, such as lowering your cable or internet costs.

5. Investing Options: Explore investment opportunities and receive guidance tailored to your goals.

6. Automatic Savings: Set up automatic transfers to save money effortlessly.

7. Expert Advice: Consult with financial advisors for personalized guidance and financial planning.

8. Financial Health Check: Receive insights into your financial health and suggestions for improvement.

9. Cash Advance: Access interest-free cash advances to cover unexpected expenses.

10. Bank-Level Security: Benefit from robust security measures to protect your financial information.

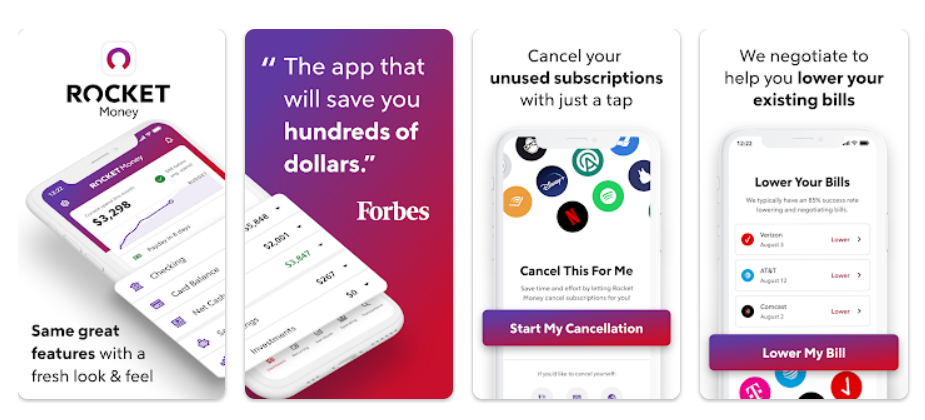

10. Rocket Money

Rocket Money (formerly Truebill) is your primary financial control center. The app automatically tracks different accounts and helps you navigate your finances each month in order to provide a clear picture of your income and expenses.

Features :

1.Bill Tracking: Monitor and track your bills in one place.

2. Subscription Management: Easily manage and cancel subscriptions to save money.

3. Budgeting Tools: Create budgets and track your spending to achieve your financial goals.

4. Expense Categorization: Automatically categorize your expenses for better financial insights.

5. Bill Negotiation: Truebill can help negotiate lower rates on your bills to save you money.

6. Fee Tracking: Identify and track hidden fees in your accounts and subscriptions.

7. Savings Opportunities: Discover ways to save money on your bills and recurring expenses.

8. Smart Notifications: Receive alerts and reminders for upcoming bill payments and potential savings.

9. Refund Monitoring: Track and claim refunds for services you may be eligible for.

10. Bank-Level Security: Benefit from secure encryption and privacy measures to protect your financial information.

Frequently Asked Questions (FAQs)

Q1: Can I trust financial planning apps with my personal and financial information?

A1: Yes, reputable financial planning apps prioritize the security and privacy of their users’ information. They implement robust encryption protocols and adhere to strict data protection regulations to ensure the safety of your data.

Q2: Are financial planning apps suitable for beginners with no prior financial knowledge?

A2: Absolutely! Financial planning apps are designed to be user-friendly and accessible to individuals with varying levels of financial knowledge. They often provide educational resources, tutorials, and customer support to assist users in understanding and utilizing the app effectively.

Q3: Do financial planning apps sync with multiple devices?

A3: Yes, most financial planning apps offer synchronization across multiple devices. You can access your account and view your financial information seamlessly on your smartphone, tablet, and computer.

Q4: Can financial planning apps help me save money?

A4: Definitely! Financial planning apps offer various tools and features to help you save money. From budgeting tools to expense tracking and goal setting, these apps provide insights and recommendations to optimize your spending habits and increase your savings.

Q5: Are financial planning apps only for individuals or can they be used by businesses as well?

A5: While financial planning apps primarily target individuals, some apps offer features suitable for small businesses and freelancers. These features may include invoicing, expense tracking,

If you like this blog please comment it will keep motivating and we will try to write better blog & share this blog .

Thanks For Visiting Our Website TechwebPlanet