In the modern world, where businesses are constantly seeking efficiency and accuracy in their financial operations, the integration of artificial intelligence (AI) into accounting processes has become useful for business owners. Most of the business use account management software or tools but nowadays accounting tools use ai to speed up process and work efficiency but you don’t find top tools that can handle your accounting management so to help you we have researched and listed the Best AI accounting Tools that can boost your account management process.

How Ai Accounting Tools Works ?

AI accounting tools function by utilizing advanced algorithms and machine learning techniques. Initially, they ingest large volumes of financial data from diverse sources such as bank statements and invoices. Through natural language processing, these tools extract and categorize relevant information accurately, eliminating manual data entry and reducing errors. Subsequently, machine learning algorithms analyze the categorized data, detecting patterns, anomalies, and trends to provide valuable insights for decision-making.

Additionally, these tools automate reconciliation processes by matching transactions between different accounts and identifying discrepancies. Continuously learning from historical data and user interactions, AI accounting tools refine their algorithms, ensuring efficiency, accuracy, and compliance in accounting and financial management.

Here Are The 7 Best AI Accounting Tools

1.Xero

Xero offers a cloud-based accounting solution that’s both powerful and user-friendly, designed to meet the needs of small to medium-sized businesses. With features like real-time financial reporting, easy invoicing, and seamless integration with over 800 apps, Xero provides a comprehensive, end-to-end platform that simplifies the complexities of financial management.

Features :

- Online Invoicing: Customizable invoices with automatic reminders.

- Bank Connections: Automatic bank feeds and reconciliation.

- Expense Management: Track and manage expenses efficiently.

- Financial Reporting: Real-time reporting and financial insights.

- Inventory Management: Keep track of stock levels and orders.

Pros:

- Real-time tracking of finances.

- User-friendly interface with 800+ integrations.

- Efficient invoicing and bank reconciliation.

- Robust reporting and cash flow management.

- Accessible from any device, anywhere.

Cons:

- Some advanced features may require additional learning.

- Customization options could be limited for complex businesses.

- Occasional syncing issues with bank feeds.

- Higher pricing tiers may be needed as business grows.

2.Docyt AI

Docyt is like a digital wizard for your financial paperwork. It’s an all-in-one accounting platform that blends cutting-edge AI with user-friendly design. Imagine a smart filing cabinet that not only stores your documents but also magically organizes them, automates repetitive tasks, and keeps your books in tip-top shape. Whether you’re a business owner or an individual, Docyt streamlines your financial life.

Features :

- Automated Bookkeeping: Simplifies financial data organization and automates repetitive tasks.

- Real-Time Insights: Provides immediate visibility into financial metrics like expenses and revenue.

- AI-Powered Learning: Enhances business process understanding and efficiency through artificial intelligence.

- Continuous Reconciliation: Ensures accounting records are always up-to-date with the latest data.

- Customizable Workflows: Tailors to specific business requirements for optimal operational management.

Pros:

- Secure Vault: Docyt guards your sensitive information like a loyal dragon.

- User-Friendly: No cryptic spells here—just point, click, and presto!

- Efficiency Boost: Bye-bye manual data entry; Docyt waves its wand.

- Custom Insights: It crafts personalized reports, revealing hidden treasures.

- Multi-Entity Magic: Manage multiple businesses seamlessly.

Cons:

- Offshore Enchantments: Sometimes, dealing with distant wizards can be tricky.

- Time Zone Spells: Expect delays when crossing magical time boundaries.

- Costly Incantations: The initial setup might require a few golden coins .

3.Blue Dot

Blue Dot is like a digital wizard for your financial paperwork. It’s an all-in-one accounting platform that blends cutting-edge AI with user-friendly design. Imagine a smart filing cabinet that not only stores your documents but also magically organizes them, automates repetitive tasks, and keeps your books in tip-top shape.

Features :

- AI Tax Compliance: Utilizes artificial intelligence to ensure tax compliance.

- Taxable Employee Benefits: Simplifies the management of taxable employee benefits.

- VAT Recovery: Streamlines the process of VAT recovery for businesses.

- 360° Transaction View: Offers a complete view of employee-driven transactions.

- Automated Rule Engines: Employs configurable rules for tax-related decisions.

Pros:

- AI-driven tax compliance for accuracy.

- Simplifies taxable employee benefits.

- Maximizes VAT reclamation.

- Trusted by leading organizations.

- Robust security and privacy standards.

Cons:

- May be complex for beginners.

- Requires integration with existing systems.

- Potentially high initial setup cost.

- Over-reliance on AI could limit customization.

- Data processing may raise privacy concerns for some.

4.VIC.AI

Vic.ai is revolutionizing the accounting landscape with its AI-driven platform, optimizing accounts payable and financial decision-making. It boasts autonomous invoice processing, seamless ERP integrations, and real-time analytics, promising a significant ROI and efficiency boost. Vic.ai is not just about automation; it’s about intelligent, strategic financial management for the modern enterprise.

Features :

- Autonomous Invoice Processing: Automates the handling of invoices with minimal manual effort.

- AI-Driven Insights: Delivers actionable financial analytics powered by artificial intelligence.

- ERP Integration: Easily integrates with existing enterprise resource planning systems.

- AI Approval Flows: Enhances invoice approval efficiency through automated workflows.

- Payments Automation: Facilitates various payment methods and streamlines the payment process.

Pros:

- Achieves high efficiency and effectiveness in invoice processing.

- Offers seamless integrations with existing ERP systems.

- Provides accurate, data-driven financial insights.

- Minimizes human errors in accounting tasks.

- Features a user-friendly interface for ease of use.

Cons:

- Some users experience a learning curve when starting.

- Rare misinterpretations of invoice details may occur.

- Quality variations can be a challenge for consistency.

- The interface, while user-friendly, may have a learning curve for some features.

5.Canopy

Canopy is a dynamic practice management solution that streamlines operations for tax professionals. It offers a suite of tools designed to enhance client interactions, manage documents efficiently, and simplify practice workflows. With its intuitive design, Canopy provides a seamless experience that integrates all aspects of practice management into one platform, accessible anywhere, anytime.

Features :

- Client Engagement: Streamlines client interactions with integrated communication tools.

- Document Management: Organizes documents efficiently with centralized storage.

- Workflow Automation: Automates tasks for better project management.

- Integrated eSignature: Provides secure digital signing capabilities.

- Compliance Solutions: Includes tools for managing various compliance-related tasks.

Pros:

- User-friendly interface enhances productivity.

- Cloud-based access for flexibility.

- Continuous software improvements.

- Comprehensive client and task tracking.

- Responsive customer service.

Cons:

- Some features may have a learning

- curve.

- Dependability issues with deadlines.

- Support may be inconsistent.

- Implementation planning can be challenging.

- Promises on features are sometimes unmet.

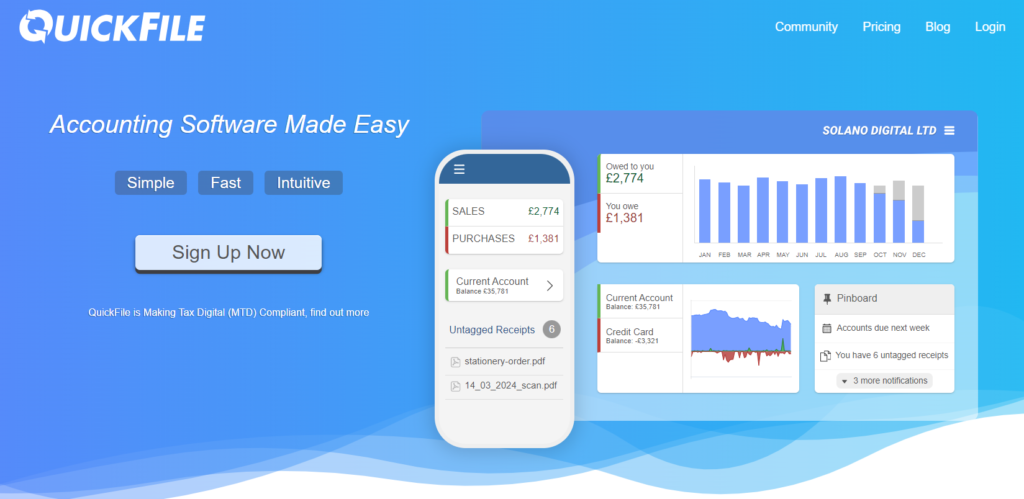

6.Quick File

QuickFile stands out as a robust, cloud-based accounting solution tailored for UK small businesses and freelancers. It simplifies financial management with features like automated bank feeds, receipt capture, and VAT handling, all within a user-friendly interface. QuickFile supports Making Tax Digital (MTD) compliance, ensuring users stay ahead of tax obligations with minimal effort.

Features :

- Automated Bank Feeds: Automatically updates transactions by connecting to UK banks.

- Customizable Invoicing: Offers a variety of invoice templates and recurring billing options.

- VAT Management: Handles different VAT schemes and is compliant with Making Tax Digital.

- Expense Tracking: Allows for easy digitization and categorization of expenses.

- Comprehensive Financial Reporting: Provides detailed reports for financial health analysis.

Pros:

- User-friendly and intuitive, ideal for non-accountants.

- Free tier available, suitable for small-scale operations.

- Automates routine accounting tasks, saving time.

- Supports MTD compliance, keeping businesses up-to-date.

- Offers a range of templates for professional invoicing.

Cons:

- Customer support primarily through forums, lacking direct contact.

- Some users report sporadic backup email delivery.

- Initial setup may be challenging for novices.

- High-volume users may find the free version limiting.

7.ignition

Ignitionapp is a comprehensive platform that transforms the way professional service businesses engage clients, bill, and get paid. It automates the entire client lifecycle from proposals to payments, streamlining workflows and maximizing revenue. With Ignition, firms can create digital proposals, automate billing, and collect payments effortlessly, all while providing a seamless client experience.

Features :

- Digital Proposals: Create and send branded proposals quickly.

- Engagement Letters: Automate the creation and sending of engagement letters.

- Automated Payments: Collect payments efficiently with automation.

- Billing Integration: Connects with accounting software for streamlined billing.

- Workflow Automation: Simplify processes with automated client workflows.

Pros:

- Streamlines client engagement and billing.

- Automates payment collection, reducing late payments.

- Offers digital proposals and engagement letters.

- Integrates with accounting software like QuickBooks and Xero.

- Reduces administrative time significantly.

Cons:

- May require adaptation for non-accounting services.

- Setup involves a learning curve.

- Relies on digital proficiency of clients.

- May not suit all business sizes.

- Integration with certain software could be smoother.

How do AI accounting tools benefit small businesses?

AI accounting tools streamline financial processes, reduce manual effort, and provide valuable insights, making them ideal for small businesses looking to optimize their operations.

Are AI accounting tools secure?

Yes, AI accounting tools prioritize security and compliance, leveraging robust encryption and compliance features to safeguard sensitive financial data.

How do AI accounting tools handle complex financial transactions?

AI accounting tools leverage advanced algorithms and machine learning techniques to analyze complex data sets and accurately process intricate financial transactions.

What sets the best AI accounting tools apart from traditional accounting software?

AI accounting tools offer advanced automation, predictive analytics, and scalability, enabling businesses to streamline financial processes and make data-driven decisions with confidence.

Conclusion

In conclusion, AI accounting tools represent the future of financial management for businesses of all sizes. By harnessing the power of artificial intelligence, these tools offer unmatched efficiency, accuracy, and insight, enabling businesses to thrive in today’s competitive landscape. Whether you’re a small startup or a multinational corporation, integrating AI into your accounting processes can unlock new levels of productivity and profitability. So why wait? Embrace the future of accounting today and take your business to new heights with AI-powered solutions.